Condo Insurance in and around Baton Rouge

Unlock great condo insurance in Baton Rouge

Condo insurance that helps you check all the boxes

Welcome Home, Condo Owners

With the variety of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm straightforward. As one of the top providers of condominium unitowners insurance, you can enjoy remarkable service and coverage that is competitively priced. And this is not only for your condo but also for your personal belongings inside, including things like sports equipment, clothing and tools.

Unlock great condo insurance in Baton Rouge

Condo insurance that helps you check all the boxes

Why Condo Owners In Baton Rouge Choose State Farm

When vandalism, a tornado or fire cause unexpected damage to your townhome or someone slips because of negligence on your part, having the right coverage is necessary. That's why State Farm offers such wonderful condo unitowners insurance.

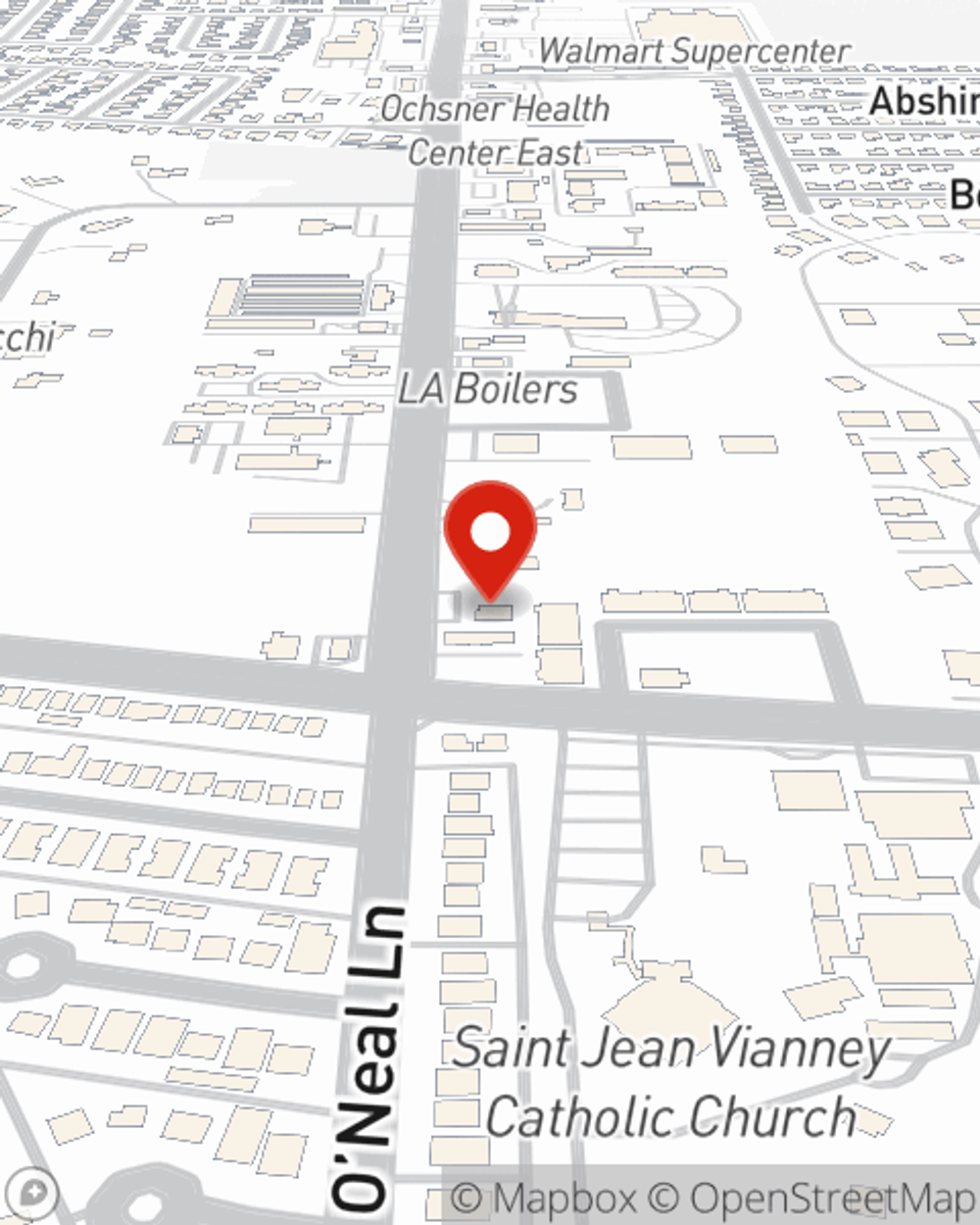

That’s why your friends and neighbors in Baton Rouge turn to State Farm Agent Beau Wofford. Beau Wofford can walk you through your liabilities and help you find the most appropriate coverage for you.

Have More Questions About Condo Unitowners Insurance?

Call Beau at (225) 756-9800 or visit our FAQ page.

Simple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Beau Wofford

State Farm® Insurance AgentSimple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.